Steep decline in nuclear energy seen as threat to climate goals

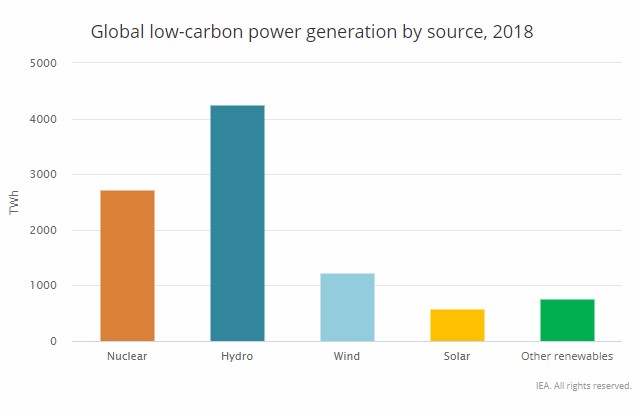

Nuclear power is the second-largest source of low-carbon electricity today, with 452 operating reactors providing 2700 TWh of electricity in 2018, or 10% of global electricity supply. It is second only to hydropower at 16%.

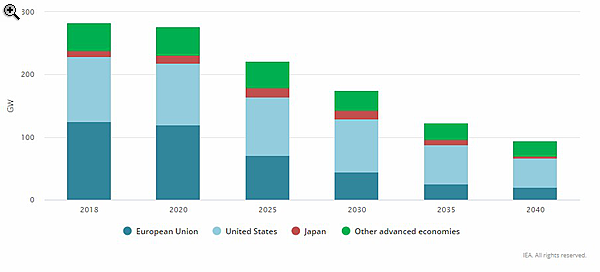

Without policy changes, advanced economies could lose 25% of their nuclear capacity by 2025 and as much as two-thirds of it by 2040,

according to the new IEA report, Nuclear Power in a Clean Energy System.

“Such a drastic increase in renewable power generation would create serious challenges in integrating the new sources into the broader energy system. Clean energy transitions in advanced economies would also require USD 1.6 trillion in additional investment over the same period, which would end up hurting consumers through higher electricity bills."

Dr Fatih Birol, the IEA’s Executive Director said on a webcast that the agency is not asking countries who have exited nuclear to reconsider, but said that countries who did decide to keep nuclear should do more to support the industry.

Birol said the low-carbon nature of nuclear and its role in energy security are currently not sufficiently valued for existing nuclear plants to operate profitably and that new nuclear projects have been plagued by cost overruns.

Without an important contribution from nuclear power, the global energy transition will be that much harder. Policy makers hold the key to nuclear power’s future. Electricity market design must value the environmental and energy security attributes of nuclear power and other clean energy sources. Governments should recognise the cost-competitiveness of safely extending the lifetimes of existing nuclear plants.

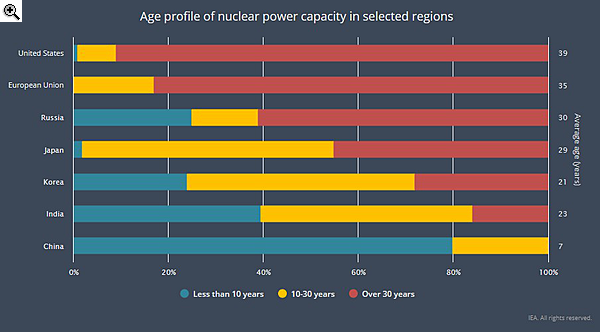

In the United States, some 90 reactors have operational licenses through 60 years, as their lifespan was extended from 40 years, yet several have already retired early, and many more are at risk due to relatively low wholesale electricity prices. French utility EDF - the world’s largest single operator of nuclear plants - also wants to make its reactors last longer.

Given these challenges, there is a possibility that the nuclear fleet in advanced economies could face a steep decline, the IEA warns. The IEA’s Nuclear Fade Case explores what could happen over the coming decades in the absence of any additional investment in lifetime extensions or new projects.

Under this case, nuclear capacity operating in advanced economies would decline by two-thirds by 2040, from about 280 GW in 2018 down to just over 90 GW in 2040.

The European Union would see the largest decline with the share of nuclear in the generation mix falling to just 4%. The share in the United states would drop from to 8%, and in Japan the share would fall to 2% - well below their 2030 target of 20-22%.

Cover photo by Shutterstock