Label: "economy"

Retail consumption grows nicely in Hungary

Retail sales up 4.6% yr/yr in August.

CEU signs MOU with Bard College, retains aim to stay in Budapest

CEU awaits signature by Hungarian government.

Banks in Hungary lend like there's no tomorrow

Central bank publishes mesmerising figures.

Unforseen risk looms over the Hungarian government

Public debt reduction might flop, which limits fiscal flexibility.

Hard to believe but yield on Hungary's short debt has risen

Seems average yield bottomed out last week.

Power usage reaches new record in Hungary this summer

Consumption up 3.15% year on year.

Hungary public debt drops and increases at the same time

Data have been revised.

Commission chief Juncker: it's premature to talk about penalties for Hungary

There should be additional dialogue before talk about financial sanctions.

Hungary's manufacturing industry on a roll

Sector hyperoptimistic.

Last quarter of 2017 starts with a busy week

Busy macro calendar before us.

Hungary cenbank sees no need to step on the lending breaks

Rules do not get tightened this time.

Good news about the Hungarian economy

We calculated how much private investments have grown.

Hungary's state budget does something amazing

Huge surplus accumulated in H1.

EU gives ultimatum to Facebook, Twitter, Google on hate speech

Patience is running out.

Hungary makes great progress in VAT gap reduction

According to new European Commission study.

It is indeed a good idea to go public with Hungary's state-owned firms

János Lázár's government info session, WEF's GCI ranking addressed too.

Yield drops to below 0.5% also on Hungary's 3-yr bond

At biweekly auction.

Moody's keeps outlook on Hungary's banking system positive

Thanks to improving economy and loan quality.

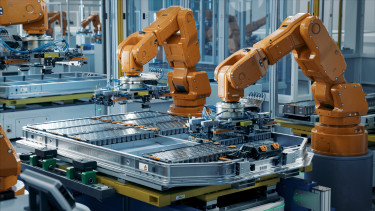

Audi to start making electric cars in all of its plants, including Hungary

20 new models over the next 7 years.

Large share of retail gov't securities are held by banks in Hungary

Debt manager chief Barcza says in interview.