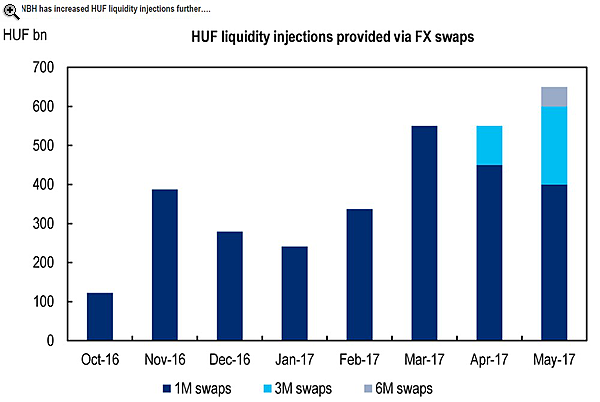

ANALYST VIEW - Hungary cenbank increases HUF liquidity injections further

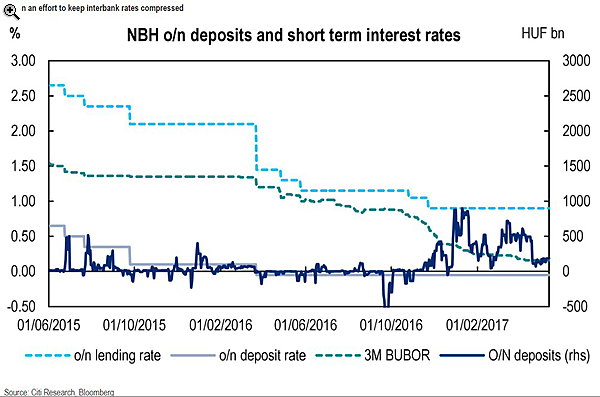

She noted that this tenor has not been auctioned yet but “is an indication of the NBH’s effort to anchor forward BUBOR expectations and we believe there may be even longer tenors added, if needed."

The recent drop in oil prices, soft CPI surprises and potential regulative price cuts (VAT and/or utility prices) may create room for the NBH to maintain its current dovish stance in the next 6-8 quarters.

Recently, monetary policy communication has increasingly put emphasis on not just keeping the policy rate unchanged (at 0.90%) but also maintaining the current loose stance of monetary conditions, Gárgyán added.“Given the low FX pass through to CPI, the NBH’s tolerance towards weaker FX and Hungary’s large structural trade surplus, the NBH is unlikely to be under pressure to tighten liquidity conditions and will likely target to keep interbank rates at current compressed levels via liquidity management until at least late 2018."