Economy

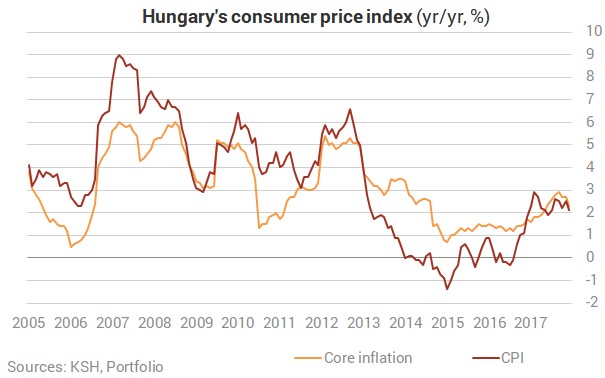

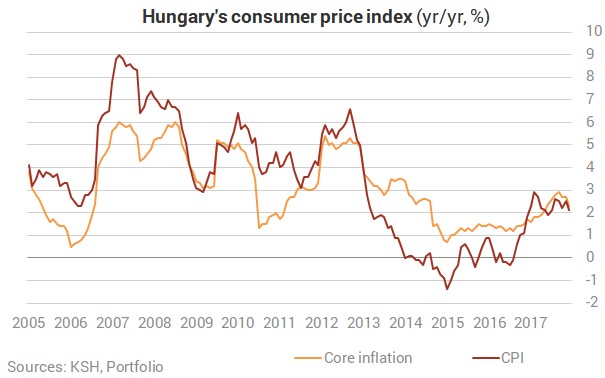

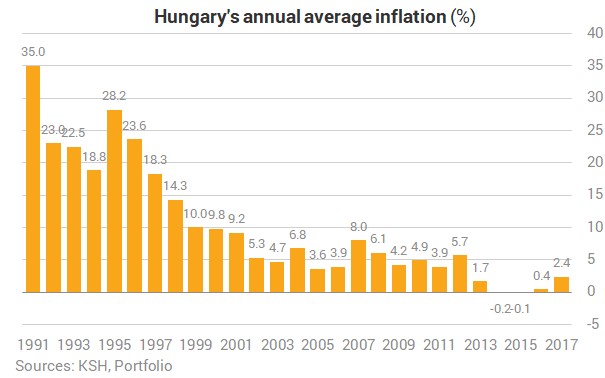

Consumer prices hardly rise in Hungary

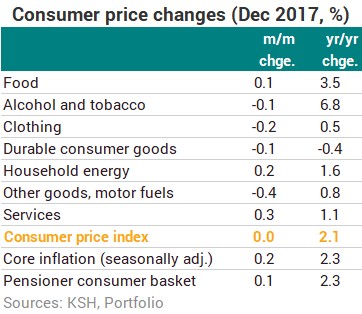

Consumer prices did not increase compared to November, which had to do with the fact that the drop in motor fuel prices was a drag on the price increase at services and food, but we see moderate decreases at the other product groups (consumer durables, clothing).

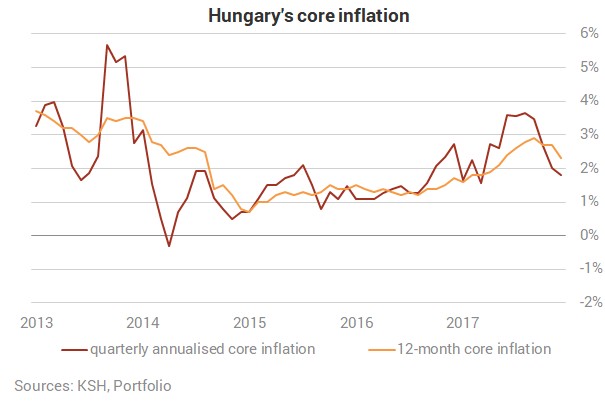

Wages could rise fast also this year, although the rate of the increase will be lower than in 2017, but this is unlikely to create meaningful inflationary pressure. At the same time, the increase of domestic demand - consumption and investment - could be gradually pushing inflation higher in the medium term. We should be keeping a close eye on the inflation data in early 2018, as re-pricings usually happen then, although most experts do not project drastic price hikes, in part because the large wage increase is partly compensated by the reduction of contributions.

Most experts believe that inflation will persistently reach the central bank’s 3.0% target only in early 2019, hence the central bank is expected to stick to its current loose monetary policy for some time.