Equity

Target price lowered for Hungary's OTP

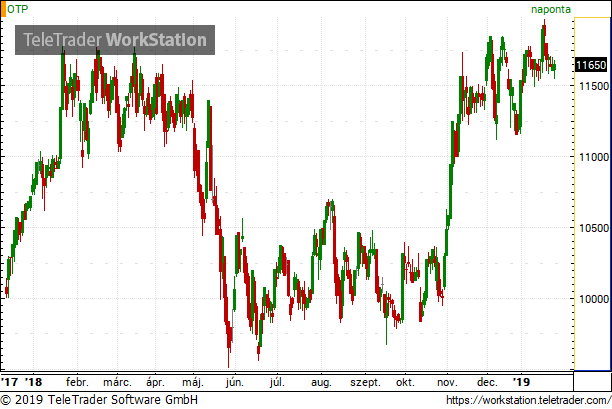

- J.P. Morgan has cut its target price for OTP to HUF 14,500 from HUF 14,700 previously, but the new TP is still 24% higher than OTP’s latest closing price on the Budapest Stock Exchange (BSE) on Friday.

- Analysts’ consensus forecast at Reuters is HUF 11,992, which is merely 3% higher than OTP’s closing price on 25 January.

- According to the latest research notes, there are 11 ‘Buy’, 1 ‘Hold’ and 2 ‘Sell’ recommendations for OTP.

- OTP’s share price edged up 3% this year so far.